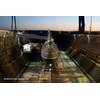

A next generation autonomous underwater vehicle (AUV) designed for deep sea military, commercial and scientific applications, the ThunderFish Alpha, has been delivered to Kraken Sonar Systems Inc., a wholly-owned subsidiary of Kraken Sonar Inc.

The ThunderFish Alpha AUV – formerly known as DEDAVE – was developed by Germany's Fraunhofer Institute and will be used as a technology demonstrator platform to support ongoing development of Kraken's underwater sensor and robotics programs.

In March 2017, Kraken announced an exclusive licensing agreement for underwater robotics technology with the Fraunhofer Institute, a European applied research organization. Since 2012, Fraunhofer has been developing intellectual property related to underwater robotics. Over C$6 million has been invested in Fraunhofer's underwater robotics programs, culminating in the development of the DEDAVE AUV, which has now been acquired by Kraken.

The Fraunhofer AUV program was developed to create a versatile and compact vehicle that's easier to handle than existing systems while providing increased modular payload space and faster turn-around survey times. The vehicle can operate in ocean depths up to 6,000 meters and is equipped with state-of-the-art sensor systems; including Kraken's AquaPix MINSAS sonar. Other sensors include obstacle avoidance sonars, multi-beam echo sounder and advanced navigation/positioning sensors. It incorporates pressure-tolerant battery technology from Kraken Power GmbH, Kraken's DataPod data storage modules and a distributed control system architecture. This allows the AUV to quickly complete survey missions, offload survey data, enable efficient integration of additional payloads and provide more battery capacity for increased operational endurance.

Kraken said it plans to upgrade ThunderFish Alpha with larger sensors, including Kraken's MINSAS 120 sonar with Real Time SAS Processor and its SeaVision 3D Underwater Laser Imaging System. The vehicle size will be increased to support the larger payload capacity and the addition of tunnel thrusters to provide hovering capability for target inspection and precision maneuvering.

While the ThunderFish Alpha platform will be used primarily as a technology demonstration platform, it will also test operational performance related to maritime Robotics as a Service.

Karl Kenny, Kraken's President and CEO, said, "The delivery of ThunderFish Alpha is yet another milestone in Kraken's evolution to becoming a vertically integrated underwater robotics company. Over the past few years, AUVs have evolved from an emerging, niche technology to a viable solution and an established part of operations in military, commercial and research applications. The recent shift in industry focus from AUVs being platform/hardware-centric to becoming sensor/software-centric is creating significant sector growth potential for cost-effective and autonomous platforms."

Emergence of Robotics as a Service

"The general trend among many technology providers is a long-term migration away from selling products to selling services and this also holds true in underwater robotics. We believe that future development of underwater robotic intelligence will come in the form of providing high resolution seabed pixels by the hour via Robotics as a Service (RaaS). Instead of selling hardware, pure-play RaaS firms will build, own, operate, maintain and innovate their robotic fleets and provide customers a recurring service that is significantly more responsive than capital-intensive purchase and high total costs of ownership. Customers will see reduced costs and their needs more tightly addressed while RaaS firms benefit from value-based recurring revenue streams, faster product innovation and a much closer connection with market-product fit. In our analysis, customers do not want to own and operate their ocean drones – they want to rapidly generate seabed intelligence from the data that the platforms acquire. While we expect certain customer groups will want to continue to buy AUVs, we believe RaaS will see significantly increased adoption in the coming years."

AUVs for Offshore Oil and Gas

In the current economic environment, oil and gas operating companies are seeking reductions in operating costs and improvements in operational efficiencies to achieve viable financial returns on their operations. AUVs hold the potential to meet this challenge through cost-effective deployment of advanced subsea sensors, navigation and positioning technologies.

Today's costs for deepwater asset integrity are primarily driven by high-powered work-class Remotely Operated Vehicles (ROVs) deployed from large ROV support vessels. ROV systems employed for deepwater facilities inspection typically include launch and recovery system, winch and umbilical and operations and support containers that can easily reach 100 metric tons on deck. When coupled with a dynamically positioned surface vessel, daily costs can easily exceed $150,000 and require a crew of up to 40 or more personnel. In addition, ROV umbilical and tether management in harsh ocean environments can create hazardous conditions for both shipboard and subsea equipment.

AUVs can offer significant improvements in safety and operating efficiencies as well as substantial reductions in cost over conventional methods. They can be deployed from smaller vessels, employ smaller crews and operate from field resident subsea docking stations, thereby reducing the number of people at sea and reducing or eliminating the number of vessel days required. Because AUVs are inherently faster and more stable platforms than ROVs they can deploy a wide range of sensor technologies (including high resolution sonar, laser, magnetic, video and others) and collect higher quality data with higher area coverage rates and significantly lower cost.

Unmanned Underwater Vehicle Market

The unmanned underwater vehicle market is experiencing an advanced rate of growth due to the increasing demand in military, commercial and scientific research applications. Significant AUV demand is expected in the commercial sector, predominately from oil and gas operators – a despite the volatility of oil prices. There has also been substantial interest in the technology from the offshore renewable energy sector, as operators have begun to understand the cost saving potential of AUVs for inspection of underwater assets. Research analysts Technavio, forecasts that the global AUV market is expected to grow from US$600 million in 2015 to over US$2 billion by 2020.

Market researchers Douglas Westwood the World AUV Market Forecast covers all key commercial themes relevant to companies across the value chain in all AUV sectors. The report considers the prospective demand for AUVs in the commercial, military and research sectors over the next five years. Highest growth is expected to come from the commercial sector, which will enable a wide range of applications to emerge in the offshore oil and gas industry (life-of-field, pipeline inspections and rig moves) also in civil hydrography, in addition to existing work in site and pipeline route surveys. North America will continue to dominate global AUV expenditure, predominantly on military unmanned technology. Africa and Latin America are set to experience the highest growth, driven by deepwater oil and gas activities in pre-salt areas. Demand in Asia will be varied with research activities in Japan, deepwater expenditure in India, Indonesia and Malaysia and military investment in China.

•

August 2024

August 2024